While February was a very doldrums sort of month, for this project, March was awesome. And that was because I met my goal.

That’s right.

I paid off my student loans!!!!!!

You might recall that at the end of last month I was tempted to use my emergency fund to pay off the rest. But I did not deplete the rest of my emergency fund. That was because I knew I hadn’t yet done my taxes.

You might recall that at the end of last month I was tempted to use my emergency fund to pay off the rest. But I did not deplete the rest of my emergency fund. That was because I knew I hadn’t yet done my taxes.

I’ve read a lot of financial advice that says that you should try to break even with your tax withholding. That if you are getting large tax refunds, you should adjust your withholding to get a larger paycheck monthly.

I can see the wisdom in that. But I also know that I love windfalls. And my tax refund–even though it’s my money the government has been holding for me and I haven’t even been earning paltry interest on it–my refund is a very fun windfall. Before the combination of YNAB and a higher salary meant that my monthly budget more or less met all my needs, my tax refund was a time of year to say, “oh good, I can replace my old shoes.” And I always used it for some sort of “treat,” sometimes a smaller treat in the one hundred dollar range, sometimes a large treat, like the computer I’m typing this entry on; which took up a big chunk of my 2009 tax return.

And this year, I knew that my tax return was going to go in full towards paying off my student loan.

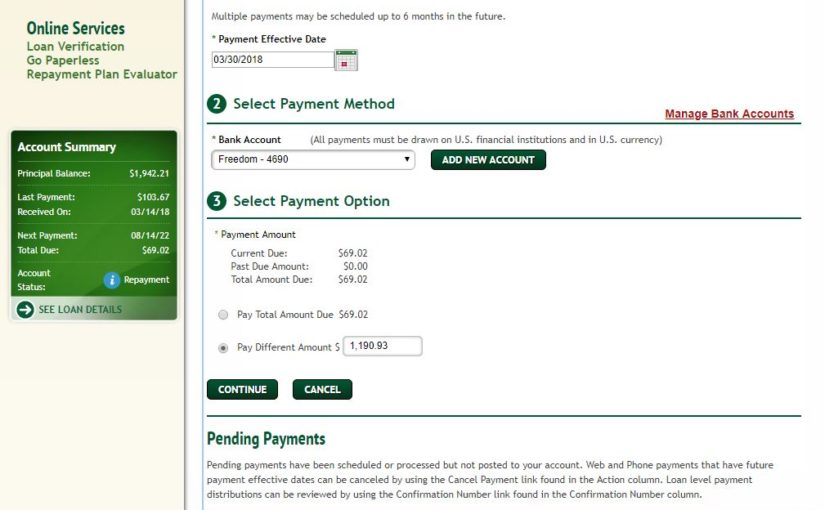

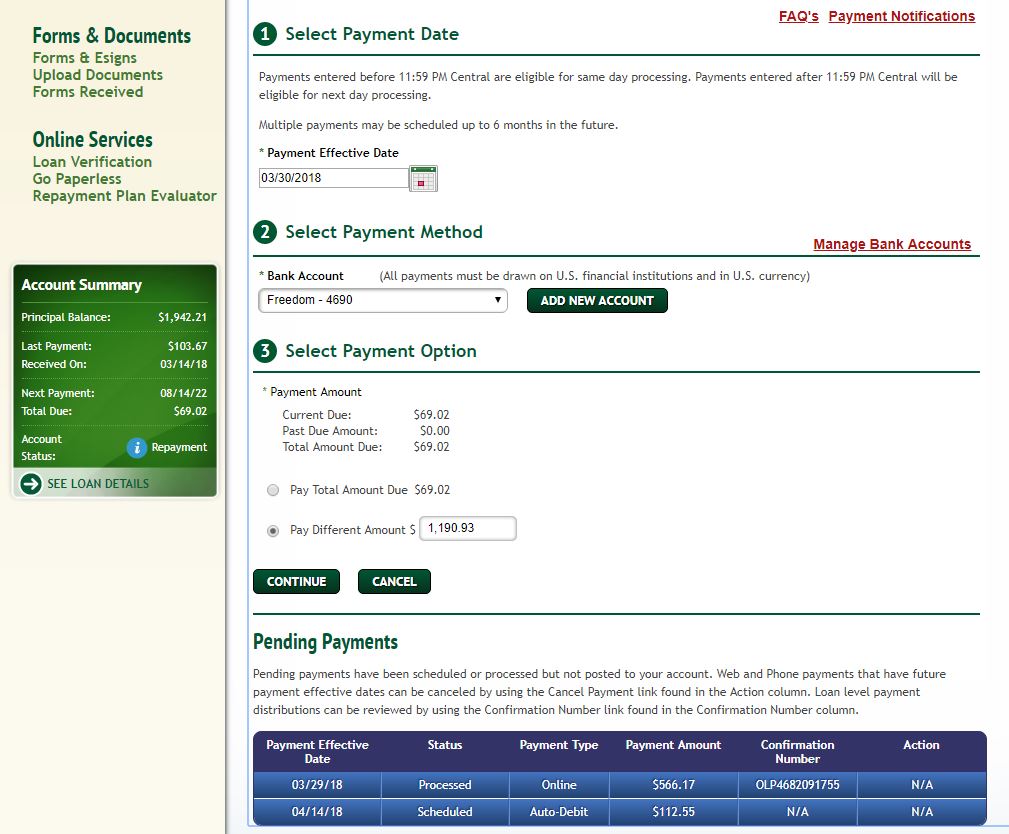

So here’s what happened. Mid-March, my usual payment of $103.67 was withdrawn. I got an alert that my April payment will be $112. Due to the graduated nature of my loan, the payment gets slightly higher every two years. But I’m thinking, “If things work out, I’m not going to have to make that $112 payment.

At the end of March I make a good overpayment of $566.17. My initial budgeted amount was $498.67 and then I did not keep track of where the rest came from. Probably Matt paying me for food. That is usually in the $70 range. At this point, the amount left on my loan was $1,378.13.

But I’d done my taxes by that time and I knew my refund was coming. It arrived from both state and federal governments (thank you electronic transfer) and I turned right around and made a payment of $1,190.93 on 3/31. That left a balance of $187.29.

But what else happens on 3/31? (Actually on 3/30 because 3/31 was a Saturday.) That’s right! I get paid. And when I’m slapping my money into my budget categories, I have more than $187.29 in my Goals: Loan Paid by 2020 category. Not to mention the amount I’d already budgeted in my monthly payment category.

So I did the thing that I’ve been longing to do for years. I clicked on the link that said, “estimate payoff amount.” The amount, due to interest, was $187.36 and so I authorized that payment.

By April 2 my balance was zero.

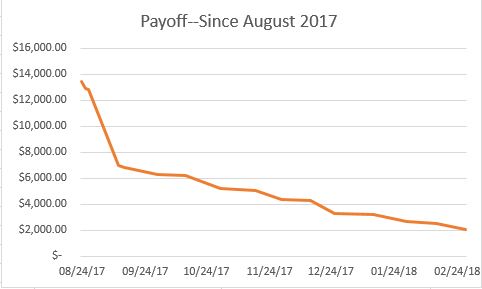

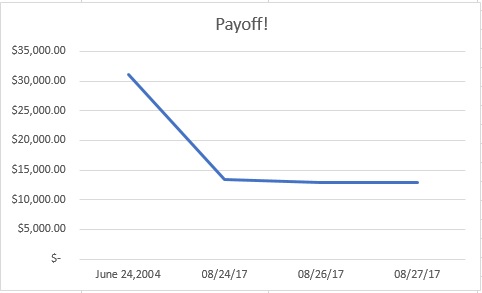

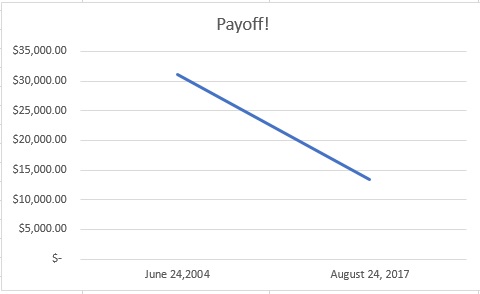

I love that death squiggle at the end. Take that, loan balance!

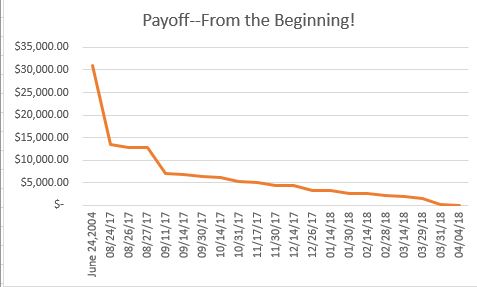

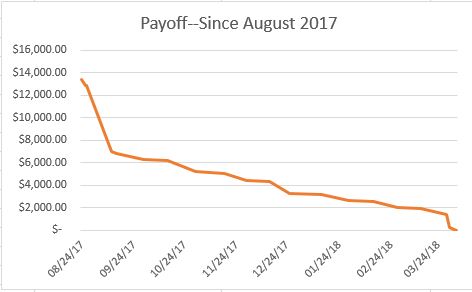

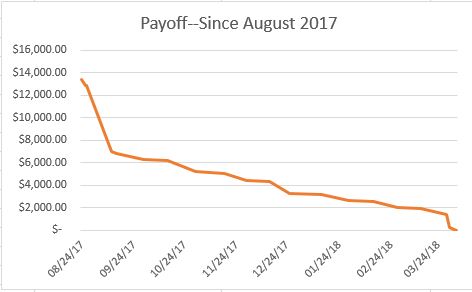

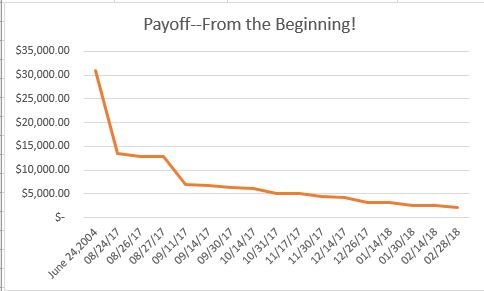

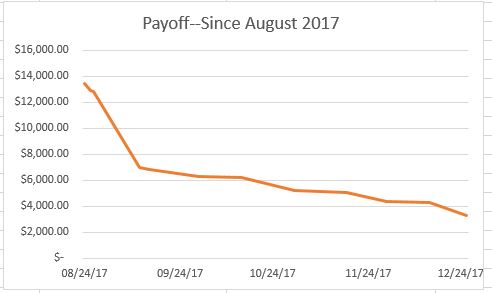

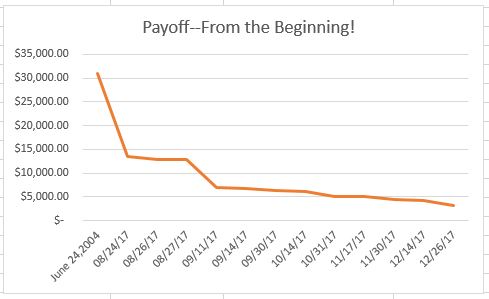

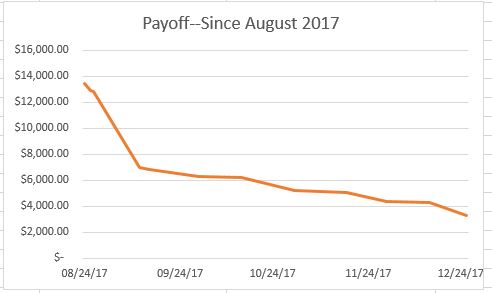

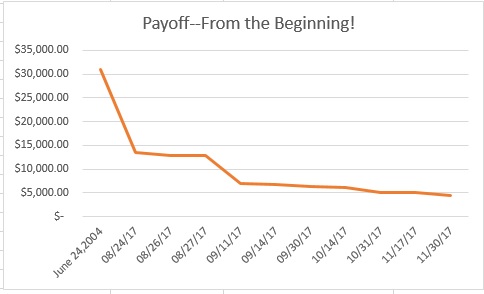

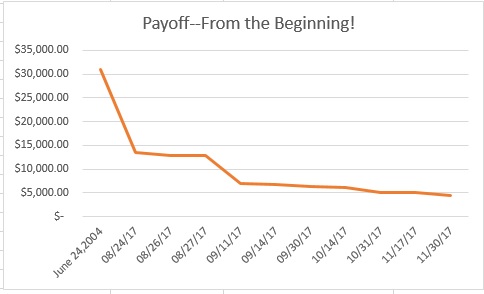

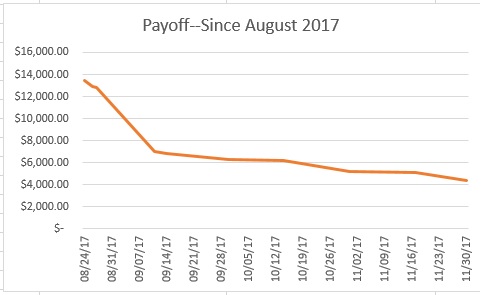

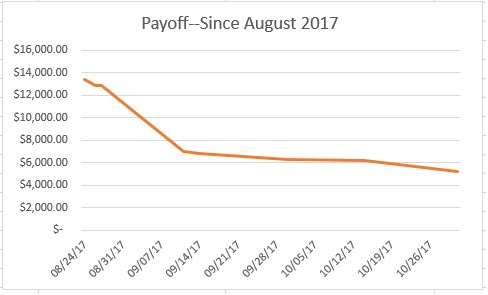

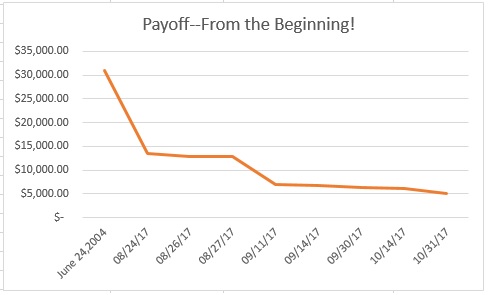

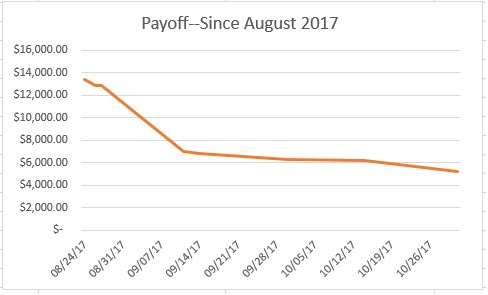

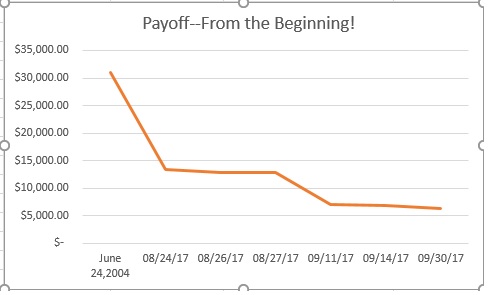

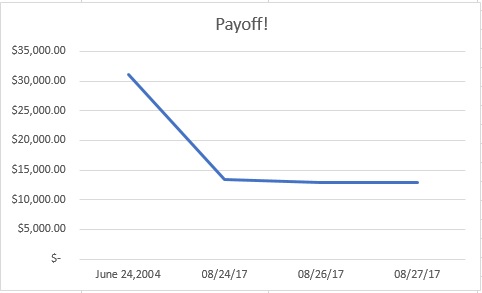

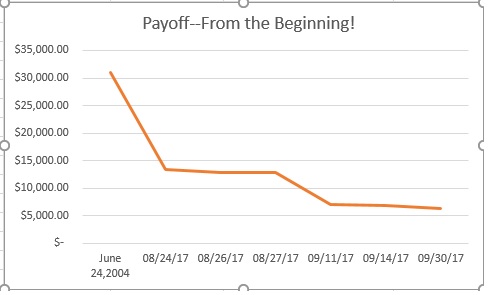

I’m so very glad to have achieved this goal. And I’m quite proud of my progress. Since August 26, I have paid $13,537.68 towards this goal. And while $5852 was from my emergency savings, paying $7685.68 in seven months is nothing to sniff at.

Achieving this goal (and so quickly, as I had forecast June or July as the complete date) has given my confidence to go for my next goal which is to rebuild my emergency fund. And I have a yearly financial goal of saving 45% of my net pay. I think I can hit that goal, too.

Mr. Money Mustache says that when it’s time to reward yourself, to buy yourself a burrito, give yourself a pat on the back and set your next goal. I’m going to buy myself something a little bigger: a new computer. Of the list of things not bought in service of this goal (list: New computer, Instapot, poetry post, reverse loft, emergency savings, tap dance, new slippers) it’s the thing I would like to do first. My computer is nine years old and while it’s a workhorse, it’s starting to falter. I don’t want to be without a computer.

After that, I’m going to set milestone goals on the path to rebuilding my emergency fund.

While all that is happening, I’m going to enjoy being a person only carrying one debt: her half of the mortgage.

And here is my progress.

And here is my progress.