Much to report this month! I made a big decision.

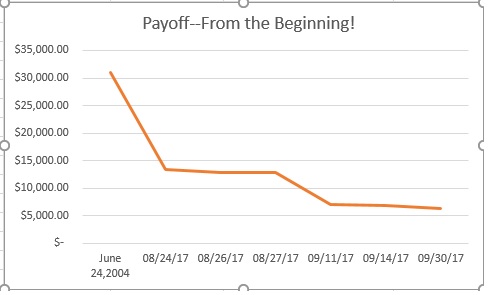

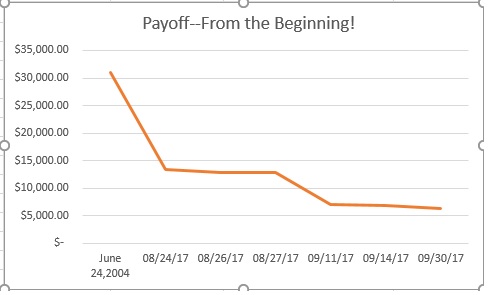

What I paid toward the loan in September. $6567.25. That includes my regular payment of $189.37, plus a payment of $5852.00, plus an end-of-the-month payment of $525.88.

How much I paid toward the principal and how much toward the interest. Principal: $6567.25. Interest: $23.20.

Where the money for my extra payments came from. I had a $10,000 emergency fund, a goal I finally achieved right before my 40th birthday. It was depleted by about 20% this year when I learned that my health insurance that my employer pays $485 per month for doesn’t really cover that much. I had been focusing my efforts on getting money back into that fund. But looking at my loan balance, I saw that there were two loans, one for $5k+ and one for $7k+. What if I paid off the $5k+ totally? On the one hand, that would deplete my emergency fund down to a little over one month’s cushion. On the other hand, I could totally eliminate one part of my debt. I eventually decided to do it, as you can tell from the above numbers. My rational is that my job feels pretty secure (knock on wood) and the amount of interest my savings account is paying is far less than the interest on this loan. Plus, the psychological boost. So I did it. I had to write the loan company to find out how to apply the entire chunk only to one loan. It turned out to be easy. I made the payment, and then sent a message to apply all of the payment to the loan in the amount of $X. Boom! When you look at my loan list, that loan is gone.

In addition, at the end of the month, I added to my budgeted amount ($324.07) another $201.81. That came from my unused Dining Out money ($40.00–all of my eating out in September was paid for by my company, or by a friend as thanks for resume help) and also my unused grocery money ($49.81). I made two lifestyle changes this month. One was I decided to stop taking tap dance lessons. I’ve been feeling too busy during the week for a while now, but had made a stink about having an Intermediate Level Tap class, so then had to take the lessons. At the time, they were running the class with only two people total, so I kept going because I liked it, but also because I didn’t want to be the person who made the stink and then didn’t sign up. There are a few more people in the class now, so I feel like I can take a break.

Also, TriMet now allows you to buy the amount of train fare you need for the month. I figured if I could ride my bike one day per week, and then also walk one way one day per week, I could pay less than $100/month. My company reimburses for transportation, phone and internet up to $100/month, so this month I submitted my phone bill along with my TriMet fare purchase and netted an extra $29.50 to put toward this goal. We shall see how this biking to work and walking once per week goes. I’m feeling excited about it now, but I was pretty burnt out biking to my previous job. Though that was every day. Also I wasn’t necessarily choosing it. I wasn’t really paid enough to afford to bus to work. (Thank goodness that job is over!)

A list of what I didn’t buy in order to put more money toward this project. To sum up: most of my emergency fund; tap dance class; full monthly TriMet pass.

Any roadblocks I’m having toward this goal. I’m worried that this will become a tedious, sad task after this month. I’m down to less than $6k, but I feel as though I have plucked all the low-hanging fruit. I can’t just decide in October to pay the rest off in one fell swoop, because I don’t have another $6k hanging around. Hopefully this will not be the case. If so, I will have to figure a plan.

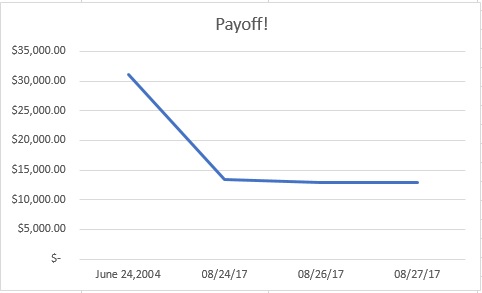

Here’s what things looked like at the end of August:

Wow! That is amazing. well done. I know that a lot of decisions were made to support this pay off, but boy-oh-boy that chart is amazing to look at!

Thanks. The chart itself is a cheat, because there are no dates between the initial date and the start of the project. It wouldn’t have two dramatic drops in that case, just one. But I was too lazy to type in 10 years of months.

Congratulations! I know that from here on out, the debt may not disappear as quickly as you’d like, but I’m truly impressed by everything you’ve done to put more money toward paying it off. Many people (myself included) aren’t this motivated or dedicated. Keep at it!

Thanks for the encouragement, especially since February might not have much progress toward my goal.