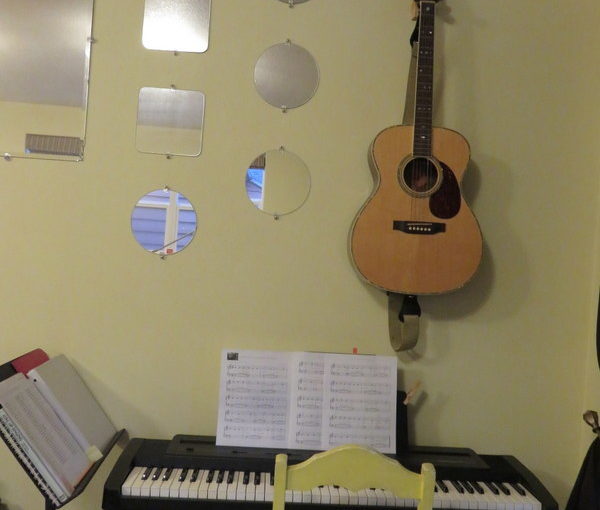

In the spring or summer of 1989 my mother drove us to a music shop on Chinden Boulevard, where she paid $40.00 for an acoustic guitar. (It may have been $60, but for years I’ve called that guitar the Forty Dollar Guitar.)

She bought me the guitar–and also lessons–so that I could be in ninth grade Jazz Band, playing jazz guitar. When it came time to pick who was going to be in Jazz Band, there was another guy who was very good at the guitar and would have made a great addition to the West Junior High Jazz Band. But he refused to take both Concert Band and Jazz Band. I said I would take both, and thus I became the jazz guitarist. This was a terrible idea, as I’m not the kind of person who can go from no knowledge of an instrument to jazz-level competence over a few months. We placed last at the 1990 Lionel Hampton Chevron Jazz Festival, though I like to think I wasn’t the only cause.

After that failure, I picked up the guitar intermittently. My musical talent includes learning new instruments quickly, progressing to a certain point of mediocrity, and then going no further. I played a lot in 1995, when the transition between College Part I and II didn’t go as smoothly as I wanted. And I made a full push to really learn this guitar, dammit, in 2006, even taking lessons and practicing regularly. That’s when I bought the current guitar. That push ended when we bought the house in 2007.

I have fond memories including guitars. There was my introduction to Rise Up Singing, that day at Cottey when Jennifer Comeau got out her guitar and we sang together in the parlor. The year my boss turned 50, we had a summer plan to assemble a songbook for her 50th birthday party. Daily, we got out our guitars and worked through songs, getting the song in the best key for singing and the chords in the right place for people to play along with. We used the forty dollar guitar for a couple of years when we sang every day at 10am. She would play and we both would sing.

And that’s the problem. I never really took to the guitar. I think I’m a horizontal musician, not a vertical one. When you learn chords on the piano, there is a straight line of keys laid out before you, and it’s easy to see how they are formed, and easy to move up or down an octave. On the guitar, you first learn the pattern your fingers take, then maybe eventually the notes that make up the chord.

Also, with a guitar, when you want to play you have to remove your instrument from a box (or hook, or stand) and fiddle with it to make sure it’s in tune. When you go to play piano, you just sit down. For some reason, those extra steps were more of a barrier to practice.

I never got good enough at the guitar so I could play and sing at the same time. And since I love singing more than guitar playing, it made sense to let the guitar go. Even knowing that, it was hard to do. I still have the fantasy of an impromptu jam session breaking out in the living room. But it’s been 10 years, and that hasn’t happened yet, so it’s time to let the guitar go.

Here’s to admitting something isn’t going to become my thing.