One could make the argument that this is more of a Eugene car. I see that now. I’m going to argue that the presence of the boat-thing on the roof makes this a Bend car.

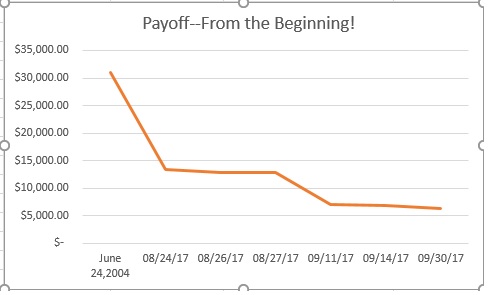

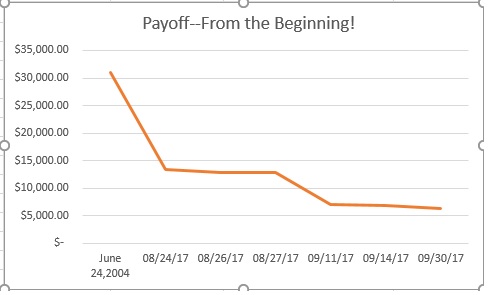

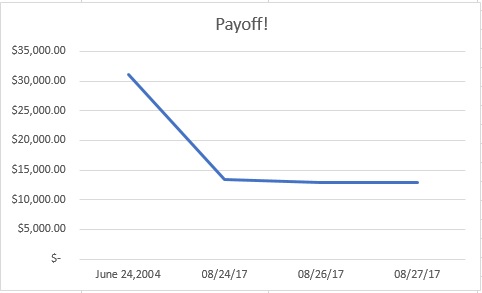

Debt Repayment Calculator

Accelerating payments is kind of boring. It’s a lot of cutting back on this and that on a daily basis, and then eventually, once per month, you have something to get excited about: WHAMMO! Extra payment.

But here we are early in the month, with September’s extra payment made and all of October left to go.

Today I found a Debt Repayment calculator that cheered me a little. The one I used is very no-frills and is found at Debt Repayment Calculator. The site even says in the upper left hand corner “You can deal with it” and has a very calming rainbow/banner thing.

I typed in my amount of debt, my interest rate and my current monthly payment. Then I added an additional monthly payment of $500 and the site told me that if I just made my monthly payments I would be paying this loan off for 72 more months and would pay an additional $543.14 in interest.

But! If I make an extra payment of $500/month for 12 months, all of my student loan debt will be GONE! Twelve months! So exciting! Then I can put all that money into savings/investing and retirement.

That’s good news!

Payoff! October report

Much to report this month! I made a big decision.

What I paid toward the loan in September. $6567.25. That includes my regular payment of $189.37, plus a payment of $5852.00, plus an end-of-the-month payment of $525.88.

How much I paid toward the principal and how much toward the interest. Principal: $6567.25. Interest: $23.20.

Where the money for my extra payments came from. I had a $10,000 emergency fund, a goal I finally achieved right before my 40th birthday. It was depleted by about 20% this year when I learned that my health insurance that my employer pays $485 per month for doesn’t really cover that much. I had been focusing my efforts on getting money back into that fund. But looking at my loan balance, I saw that there were two loans, one for $5k+ and one for $7k+. What if I paid off the $5k+ totally? On the one hand, that would deplete my emergency fund down to a little over one month’s cushion. On the other hand, I could totally eliminate one part of my debt. I eventually decided to do it, as you can tell from the above numbers. My rational is that my job feels pretty secure (knock on wood) and the amount of interest my savings account is paying is far less than the interest on this loan. Plus, the psychological boost. So I did it. I had to write the loan company to find out how to apply the entire chunk only to one loan. It turned out to be easy. I made the payment, and then sent a message to apply all of the payment to the loan in the amount of $X. Boom! When you look at my loan list, that loan is gone.

In addition, at the end of the month, I added to my budgeted amount ($324.07) another $201.81. That came from my unused Dining Out money ($40.00–all of my eating out in September was paid for by my company, or by a friend as thanks for resume help) and also my unused grocery money ($49.81). I made two lifestyle changes this month. One was I decided to stop taking tap dance lessons. I’ve been feeling too busy during the week for a while now, but had made a stink about having an Intermediate Level Tap class, so then had to take the lessons. At the time, they were running the class with only two people total, so I kept going because I liked it, but also because I didn’t want to be the person who made the stink and then didn’t sign up. There are a few more people in the class now, so I feel like I can take a break.

Also, TriMet now allows you to buy the amount of train fare you need for the month. I figured if I could ride my bike one day per week, and then also walk one way one day per week, I could pay less than $100/month. My company reimburses for transportation, phone and internet up to $100/month, so this month I submitted my phone bill along with my TriMet fare purchase and netted an extra $29.50 to put toward this goal. We shall see how this biking to work and walking once per week goes. I’m feeling excited about it now, but I was pretty burnt out biking to my previous job. Though that was every day. Also I wasn’t necessarily choosing it. I wasn’t really paid enough to afford to bus to work. (Thank goodness that job is over!)

A list of what I didn’t buy in order to put more money toward this project. To sum up: most of my emergency fund; tap dance class; full monthly TriMet pass.

Any roadblocks I’m having toward this goal. I’m worried that this will become a tedious, sad task after this month. I’m down to less than $6k, but I feel as though I have plucked all the low-hanging fruit. I can’t just decide in October to pay the rest off in one fell swoop, because I don’t have another $6k hanging around. Hopefully this will not be the case. If so, I will have to figure a plan.

Here’s what things looked like at the end of August:

Thanks to my southern Idaho upbringing, I will always feel at home…

Books read in September 2017

Schooling is over for the summer. Time to return to the regular reading schedule.

Schooling is over for the summer. Time to return to the regular reading schedule.

Picture Books: When’s My Birthday?

Middle Grade: Ashes to Asheville

Young Adult: Genuine Fraud (thought see the picture accompanying this post for my other favorite)

Adult Fiction: The Beautiful Land

Young Nonfiction: Take a Picture of Me, James Van Der Zee

When’s My Birthday?

Fogliano/Rubinson

Read for Librarian Book Group

As a person who enjoys her birthday, I enjoyed this book.

Ashes to Asheville

Sarah Dooley

Read for Librarian Book Group

When Fella’s mother, Mama Lacy died, Fella could have gone on living with Mama Shannon and her sister Zaney. But Fella’s grandmother Mrs. Madison thinks Fella should live “with her blood.” She goes to court, and wins, so Fella lives with Mrs. Madison, and only sees Mama Shannon and Zaney for church.

One night, Fella catches Zaney breaking into Mrs. Madison’s house. Zaney’s goal? To steal Mama Lacy’s ashes, drive to Asheville to scatter them, and be back before anyone knows she’s gone. Fella comes along, as does Mrs. Madison’s dog.

The plan to drive hundreds of miles in an old car in the middle of the night without detection falls apart quickly, and this book is full of misadventures. It’s also full of heartbreak, while managing to be quite funny. Some plot points are convenient, but overall, this book is worth reading for the love, humor and even class issues, as well as LGBTQ custody issues.

When Dimple Met Rishi

Sandhya Menon

Sandhya Menon sets up a great “meet cute” by having Dimple fully focused on her education and career, and not at all interested in being matched with a husband by her Indian family. Meanwhile, unbeknownst to Dimple, Rishi has been matched with her and is excited to begin their lives together, first by getting to know each other, then after they are married which Rishi guesses will happen after they finish college and before he goes to graduate school.

The opposite of sparks fly. Or maybe, sparks fly in one direction and are then repelled and sent right back to a surprised Rishi. This sets the stage for a delightful little reverse romance that also includes class and friendship issues, parental and sibling relations and a satisfying ending.

Genuine Fraud

E.K. Lockhart

This is Jule’s story, but her story can’t be told without also telling Imogen’s story. E.K. Lockhart lets us in on both stories as this book unfolds. A fun read, and best when one can read a large chunk at the beginning. If read in bits, this book might be confusing. Memorable characters, plus class issues. Nicely done.

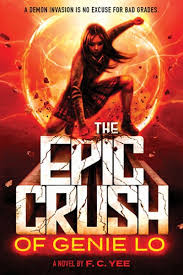

The Epic Crush of Genie Lo

F.C. Yee

Read for Librarian Book Group

This book is hilarious and the kind of outsized, bombastic story that I enjoy. It also hooked me up with some Chinese folklore, and has a punny title. Big win!

Words in Deep Blue

Cath Crowley

Read for Librarian Book Group ????

Let’s imagine that a boy goes to school in a town until he is well into middle school. Then he moves away. A few years later, he drowns. In this modern world, where we are all connected via social media, what are the chances that no one in the old town will hear of this boy’s death?

If you think the chances are zero that not one person would catch wind of this boy’s passing, you are going to have the same problem with this book as I did. The entire premise of the book rests on the dead boy’s older sister moving back to their old town, yet not a single person she encounters (except for her aunt) knows about her brother’s death. Even the friends she has kept in touch with during the years she has moved elsewhere.

There was a lot to like in this book. The friendships and romantic relationships were well developed and there was good stuff around mourning and losing things (brothers, bookshops.) However, my reading experience was marred by the continuing confusion as to why no one even mentions the dead brother and then the increasing skepticism that they wouldn’t have heard about the dead brother. I’m not sure how this book made it into publication with that largest of plot hole.

The Beautiful Land

Alan Averill

Takahiro is a washed-up American-born Japanese reality star when he goes to work for the Axon Corporation. Samira is an Iraq War veteran, crippled from PTSD. They have their Seattle childhood in common, and their friendship that never developed into something more.

Tak’s job at Axon is to explore parallel universes, which is not your normal kind of job. When it turns out that someone has other plans for parallel universes, Tak and Sam must work together to save the world. And also figure out that whole latent romance thing.

Averill balances the parallel universe and the relationships with flair. This book is high-stakes, high-action and also funny.

Take a Picture of Me, James Van Der Zee

Loney/Mallett

Read for Librarian Book Group

Picture book story of James Van Der Zee, who took portraits of people in Harlem during the 20th Century. Likable illustrations, plus actual examples of Mr. Van Der Zee’s work at the end of the book.

Top Movies September 2017

Three sentence movie reviews: Lost City of Z

A gripping tale of Percy Fawcett, explorer of the Amazon. In this tale, Mr. Fawcett is much more enlightened than his contemporaries, and respects the “primitive” societies and landscape he is exploring.* Balances nicely the adventure and the family scenes on the home front.**

Cost: $1.50 from Redbox

Where watched: at home with Matt

*I’m a bit suspicious of how much of this attitude is historically accurate to the real Percy Fawcett, and how much has to do with contemporary movie makers still wanting to make an adventure movie set in a time period where the motivations for exploration were mostly icky.

**Fun realization. Watching the DVD extras and discovering that in some countries this movie is called the Lost City of Zed. 😉

poster from: http://www.impawards.com/2017/lost_city_of_z.html

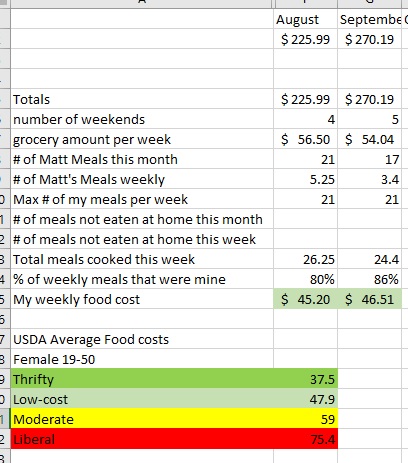

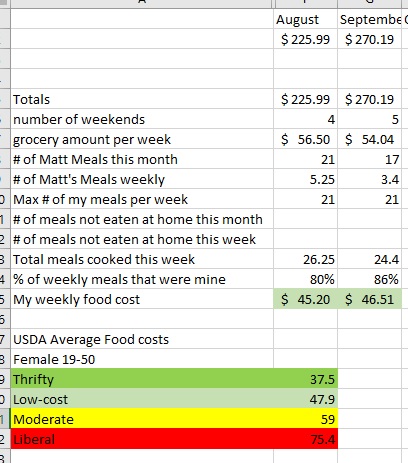

Challenge. Me, the food I eat, and the USDA Thrifty Food Plan

In looking for ways to send more of my money toward the payoff of my student loan, I’m going to focus on reducing my food costs in the last three months of 2017

There are many different ways to look at food costs. Some people lump their grocery and eating out budgets into one line. Some people look at the amount for the entire month, while others look at their food budget weekly. Some people even will break down each meal into a cost.

I have a couple of complicating factors in tracking my grocery bill. One has to do with the calendar. There are 30 days in some months, 31 in others. Some months have four weekends, some have five. Also, I make and sell meals to Matt. This came about because I needed a side job, and one of my skills is cooking. He has no desire to develop that skill in himself (thus far) and needed to reduce food costs. This has been great for both of us. For me, it’s easier to make recipes that feed more than one person. Plus, I get a little extra cash on the side. Matt gets a variety of nutritious food for less than he would pay eating out. I charge him $4.10 per meal.

A few years ago, I was searching the internet to find out what is a reasonable amount to spend on groceries. I discovered the USDA’s Food Plans. In a delightful bit of government minutia, food costs are tracked monthly and published on the USDA website. In one handy PDF document, you get food costs broken down by age, gender and family. Plus you can see the average cost under four USDA plans broken down weekly or monthly.

Example: For August 2017, a female between the ages of 19 and 50 would find the weekly/monthly Thrifty Food Plan costs to be $37.90/$164.20; the Low-Cost Plan to be $47.90/$207.50; the Moderate-Cost Plan to be $59.00/$255.80; and the Liberal Plan to be $75.40/$326.70. Note that these plans assume all meals and snacks for the week/month are prepared at home.

This is super cool and gives me a goal. Except, I also have to somehow reflect the fact that 4-6 meals worth of food per week go to a male between the ages of 19-50 years old (Thrifty food cost for that category is $42.80/$185.40). What to do, what to do?

I went back and crunched my grocery numbers from YNAB. There’s a whole spreadsheet, but I won’t make you read that. I’ll just sum up what I found.

First of all, I decided that the grocery shopping week begins on Saturday. I do my shopping on Saturday or Sunday. Thus, months that have five weekends, the total monthly food cost gets divided by 5. (Of course, October is the rare unicorn and begins on a Sunday, making things complex. I gave September 5 weekends, and October 4)

From April through September my average weekly food costs were $64.97 which puts me above the Moderate and below the Liberal Plan. Drat! Although August & September took a deep dive with $56.50 and $54.04 weekly totals.

But! Some of those food costs went to meals for the 19-50 year-old male. I don’t have data prior to August, but in August I sold Matt 21 meals and in September there were 17. (Vacation happened.)

I took the average number of Matt’s meals per week and added them to the total number of meals per week for me (7 days times 3 meals per day gives me 21 per week) giving me a total of 26.25 meals per week in August.

After that, I figured out what the weekly percentage was for my meals. In August that was 80%. Using that percentage, I could then calculate my actual average weekly meal costs. My total: $45.20 which puts me below the $47.90 Low-cost plan but not reaching the threshold of $37.90 Thrifty food plan.

I’ve realized there is a slight flaw in my data in that I don’t actually know how many meals I ate in the month. As mentioned before, vacation happened and the food budget for vacation happens outside of this grocery budget. I also don’t know how much I ate out in August, or September. Though my $40 eating out budget remained untouched all month (good job, me)a friend did buy me lunch for helping her with her resume. Plus work bought at least two lunches.

I have added lines to my spreadsheet so I can more accurately reflect the number of days I ate meals that I prepared.

My goal for October, November, December is to meet the Thrifty Plan Food costs while still eating a variety of delicious food with a lot of fruits and vegetables. I still plan to buy my red meat and poultry at New Seasons, which costs more, but I hope to offset that by doing the bulk of my shopping once per month at Winco (I have rediscovered the amazing deals) and cooking more with low-cost ingredients as well as using meat and cheese as flavor enhancers and not the main event. I will also figure out a way to better ascertain if Imperfect Produce is a good enough deal to keep going with.

Right now, I’m pleased that my grocery costs are in the Low-Cost range. But the monthly difference between the Low-Cost and Thrifty plans is $43.30. Over one year that is $519.60 that would be better off being paid toward my student loans.

September 2017 Song of the month : Independence Day by Martina McBride

This one comes to me via the Amateur Talent Contest at the Minnesota State Fair. Grace Harmoning sang it in the Teen category. I’d not heard this song before (probably due to the fact it’s a country song and my knowledge of that particular genre is sparse). I could tell it was a popular song, because several people around me were singing along.

It was only after I watched the video that I found out its subject was domestic violence.

Heat Pump!

Today is the day we get our new heat pump. Currently, our home is heated by Cadet heaters. I dislike them for a variety of reasons: You have to turn them on and off, there’s no set-it-and-forget-it option; They are expensive to run; There’s not a lot of control, they go from too cold to too hot.

I’ve been longing for a ductless mini-split heat pump for years. And since we’re putting a path in the side yard, we decided to have the heat pump installed now. That way, we would know how much space it was taking up before we put in the path.

And here’s what it looks like after! That little guy is going to heat our 1000 square foot house much more efficiently than the cadet heaters.

One thing that worked out quite well, is that the remote control–which is used to control the temperature–fits nicely where our phone jack used to be. We will always know where the remote is, and our unessential phone jack is covered.

Here’s what it looks like from outside.

The electrician had the worst job. We don’t have a crawlspace and we don’t have an attic, so he had to run the cable to the electrical panel from the outside through the dead space in the kitchen. Then he had to make a turn and sneak through the closet.

He was a bit sweaty by the end of it, and sadly lamented our lack of crawlspace.

It’s nice to have this project done. Right now the temperature is such that we don’t need the heat pump to work, so we’ve mostly been using the fan feature. This is probably the first year of my life–ever–that I’ve looked forward to colder temperatures.